Frequently Asked Questions

The sales tax legislation on LVG has come into force from 1 January 2023. However, the imposition of sales tax on LVG will only start on 1 January 2024.

All goods (excluding cigarettes; tobacco products; intoxicating liquors; smoking pipes (including pipe bowls); electronic cigarettes and similar personal electric vaporizing devices; and preparation of a kind used for smoking through electronic cigarette and electric vaporizing device, in forms of liquid of gel, whether or not containing nicotine) which are sold at a price not exceeding MYR500 and are brought into Malaysia by land, sea or air

Sellers registered with the Royal Malaysian Customs Department (RMCD) under the provisions of the Sales Tax Act 2018 (LVG).

"Seller" means a person, whether inside or outside Malaysia, who sells LVG on an online platform or operates an online marketplace for the sale and purchase of LVG

Online platform refers to a platform that provides facilities for the sale and purchase of LVG which includes marketplace operated via website, internet portal or gateway.

Yes, countries such as Australia (2018), Switzerland (2019), New Zealand (2019), Norway (2020), United Kingdom (2021) have implemented the imposition of GST / VAT on LVG.

The sales tax is charged on the sale value of LVG not including any tax, duty, fee or other charges such as transportation, insurance or other costs.

The sales tax rate on LVG is 10%.

LVG sellers shall register if the total sale value of LVG brought into Malaysia exceeds MYR500,000 in 12 months.

A seller may apply for registration with effect from 1 January 2023. Application shall be made via https://mylvg.customs.gov.my

RS needs to submit a return for sales tax on LVG every three (3) months according to the taxable period by filling in the LVG-02 form via https://mylvg.customs.gov.my.

Ringgit Malaysia (MYR).

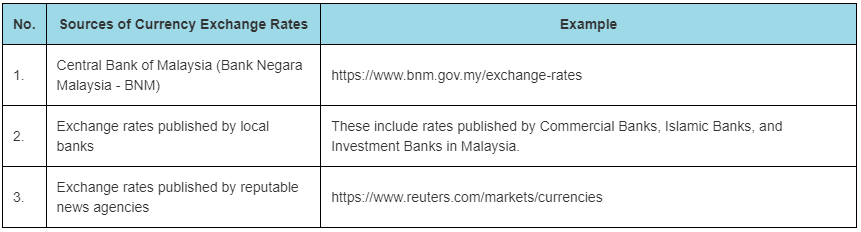

RS may use one (1) of the following suggested prevailing acceptable exchange

rates and shall use it consistently:

Yes. RS is allowed to issue credit note or debit note under the following

situations:

(i) any changes on sales tax rate on LVG in force under section 10 of the Sales

Tax Act 2018; or

(ii) financial adjustments made in the course of a business transaction

Only RS living abroad is allowed to keep documents or records related to sales tax on LVG outside Malaysia as long as the records are accessible. RS is responsible for keeping records related to LVG transactions for seven (7) years from the last date related to those records

Yes, LVG imported into Malaysia is still subject to the existing import procedures as it remains unchanged. Prohibited goods may require permits / approvals from relevant agencies prior to the goods arrival. Goods may also be screened, inspected, or examined prior to their release.

The de minimis facility under Item 94, Part I of the Schedule, Customs Duties (Exemption) Order 2017 and Item 24, Schedule A, Sales Tax (Persons Exempted from Payment of Tax) Order 2018 is still applicable.

During the importation of LVG, the LVG Registration Number information must be provided by the importer / customs agent in the import declaration (e.g., Customs Form No.1 (K1), electronic pre-alert system (e-PAM) or consignment note (CN22 / CN23). Any supporting documents must also be provided upon request by the proper officer of customs.

For K1, information about the LVG Registration Number is required to be provided in the “SST/LVG” data field in the system. As for the CN22 / CN23, it is advisable to provide the LVG Registration Number in the Exporter / Consignor column / data field.

No additional duties or taxes will be charged upon importation as the goods imported are entitled to de minimis.

Laura’s tableware must be declared using K1 and will be subjected to Import Duty and Sales Tax on Imports (if applicable) since de minimis does not apply to goods imported by road. However, Sales Tax on Imports would not be charged during importation since Sales Tax on LVG has been charged at the point of sale, provided that the LVG Registration Number is indicated in the K1.

Goods declared without any LVG Registration Number information will be charged Sales Tax on Imports (if applicable) during importation.

Importers / customs agents may select Transaction Type: “LG” and SST Exemption Type: “LG” for declaration of goods imported under the scope of LVG.

This consignment exceeds the de minimis value (CIF MYR500). Therefore, this consignment will be subjected to Import Duties and Sales Tax on Imports (if applicable). However, since Sales Tax on LVG has been charged by the RS at the point of sale on both line items, Sales Tax on Imports will not be charged upon importation. Only Import Duties will be charged upon importation on both line items.

Upon importation, the customs value declared for this kitchenware will exceed MYR460 and will be greater than the de minimis value (MYR500) as the customs value consists of cost, insurance, and freight. The value might also be affected by the foreign exchange rate. Therefore, this kitchenware will be subject to Import Duties and Sales Tax on Imports (if applicable) since the de minimis facility does not apply. Importers / customs agents must provide supporting documentation to the proper officer of customs to prove that the Sales Tax on LVG has been charged. Sales Tax on Imports will not be charged upon importation if it is proven that the Sales Tax on LVG has been charged by the RS at the point of sale. If it is proven at this juncture, only Import Duties will be imposed

Soalan Lazim

The sales tax legislation on LVG has come into force from 1 January 2023. However, the imposition of sales tax on LVG will only start on 1 January 2024.

All goods (excluding cigarettes; tobacco products; intoxicating liquors; smoking pipes (including pipe bowls); electronic cigarettes and similar personal electric vaporizing devices; and preparation of a kind used for smoking through electronic cigarette and electric vaporizing device, in forms of liquid of gel, whether or not containing nicotine) which are sold at a price not exceeding MYR500 and are brought into Malaysia by land, sea or air

Sellers registered with the Royal Malaysian Customs Department (RMCD) under the provisions of the Sales Tax Act 2018 (LVG).

"Seller" means a person, whether inside or outside Malaysia, who sells LVG on an online platform or operates an online marketplace for the sale and purchase of LVG

Online platform refers to a platform that provides facilities for the sale and purchase of LVG which includes marketplace operated via website, internet portal or gateway.

Yes, countries such as Australia (2018), Switzerland (2019), New Zealand (2019), Norway (2020), United Kingdom (2021) have implemented the imposition of GST / VAT on LVG.

The sales tax is charged on the sale value of LVG not including any tax, duty, fee or other charges such as transportation, insurance or other costs.

The sales tax rate on LVG is 10%.

LVG sellers shall register if the total sale value of LVG brought into Malaysia exceeds MYR500,000 in 12 months.

A seller may apply for registration with effect from 1 January 2023. Application shall be made via https://mylvg.customs.gov.my

RS needs to submit a return for sales tax on LVG every three (3) months according to the taxable period by filling in the LVG-02 form via https://mylvg.customs.gov.my.

Ringgit Malaysia (MYR).

RS may use one (1) of the following suggested prevailing acceptable exchange rates and <b>shall use it consistently:</b> </br> <img style="max-width: 70%" src="/img/currency.png"/>

Yes. RS is allowed to issue credit note or debit note under the following situations: <br/> (i) any changes on sales tax rate on LVG in force under section 10 of the Sales Tax Act 2018; or <br/> (ii) financial adjustments made in the course of a business transaction

Only RS living abroad is allowed to keep documents or records related to sales tax on LVG outside Malaysia as long as the records are accessible. RS is responsible for keeping records related to LVG transactions for seven (7) years from the last date related to those records

Yes, LVG imported into Malaysia is still subject to the existing import procedures as it remains unchanged. Prohibited goods may require permits / approvals from relevant agencies prior to the goods arrival. Goods may also be screened, inspected, or examined prior to their release.

The de minimis facility under Item 94, Part I of the Schedule, Customs Duties (Exemption) Order 2017 and Item 24, Schedule A, Sales Tax (Persons Exempted from Payment of Tax) Order 2018 is still applicable.

During the importation of LVG, the LVG Registration Number information must be provided by the importer / customs agent in the import declaration (e.g., Customs Form No.1 (K1), electronic pre-alert system (e-PAM) or consignment note (CN22 / CN23). Any supporting documents must also be provided upon request by the proper officer of customs.

For K1, information about the LVG Registration Number is required to be provided in the “SST/LVG” data field in the system. As for the CN22 / CN23, it is advisable to provide the LVG Registration Number in the Exporter / Consignor column / data field.

No additional duties or taxes will be charged upon importation as the goods imported are entitled to de minimis.

Laura’s tableware must be declared using K1 and will be subjected to Import Duty and Sales Tax on Imports (if applicable) since de minimis does not apply to goods imported by road. However, Sales Tax on Imports would not be charged during importation since Sales Tax on LVG has been charged at the point of sale, provided that the LVG Registration Number is indicated in the K1.

Goods declared without any LVG Registration Number information will be charged Sales Tax on Imports (if applicable) during importation.

Importers / customs agents may select Transaction Type: “LG” and SST Exemption Type: “LG” for declaration of goods imported under the scope of LVG.

This consignment exceeds the de minimis value (CIF MYR500). Therefore, this consignment will be subjected to Import Duties and Sales Tax on Imports (if applicable). However, since Sales Tax on LVG has been charged by the RS at the point of sale on both line items, Sales Tax on Imports will not be charged upon importation. Only Import Duties will be charged upon importation on both line items.

Upon importation, the customs value declared for this kitchenware will exceed MYR460 and will be greater than the de minimis value (MYR500) as the customs value consists of cost, insurance, and freight. The value might also be affected by the foreign exchange rate. Therefore, this kitchenware will be subject to Import Duties and Sales Tax on Imports (if applicable) since the de minimis facility does not apply. Importers / customs agents must provide supporting documentation to the proper officer of customs to prove that the Sales Tax on LVG has been charged. Sales Tax on Imports will not be charged upon importation if it is proven that the Sales Tax on LVG has been charged by the RS at the point of sale. If it is proven at this juncture, only Import Duties will be imposed

Visitor Information

Maklumat Pelawat